Angela Wilson | [#today : %B %e, %Y] | FairOffer | Advertorial

How to Stop a Foreclosure: What Steps You Need to Take Today for a Better Tomorrow

Despite limited options, there is still hope right up until the moment of auction.

A foreclosure is entirely avoidable if you take action now.

If you're behind on your mortgage and possible facing foreclosure closure, you're not alone. In fact, there are 3.04 million Americans who are in a difficult financial position just like you. There is good news, however. You can get out of this situation and get a fresh start. Make sure you read this article to the end.

Understanding the foreclosure process.

A foreclosure is a legal process in which a lender attempts to recover the balance of a loan from a borrower who has stopped making payments by forcing the sale of the asset used as the collateral for the loan, typically a home. The process begins when a borrower fails to meet their mortgage payment obligations, and the lender files a default notice, which is the formal indication that the foreclosure process is commencing. This is often seen as a last resort by lenders, as it involves significant cost and time, and they generally prefer to work out a payment arrangement or modification to the loan terms if possible.

After a few missed payments, a lender will send you a notice of default.

You don't want a foreclosure on your record.

Having a foreclosure on your record is the worst financial setback you can encounter. The immediate and most palpable impact is the severe damage it does to your credit score. A lowered credit score affects not just your ability to borrow money in the future; it will increase the cost of borrowing significantly. You'll see higher interest rates on loans and credit cards.

A tarnished credit history can lead to increased premiums on your home and auto insurance, as insurers view you as a higher risk. These repercussions underscore the importance of managing your mortgage responsibilities wisely or seeking alternative solutions if you find yourself struggling.

Beyond financial services, the implications of a foreclosure extend into other areas of your life, such as employment. If you're in any field where financial responsibility is crucial, a foreclosure will limit your job prospects. Employers perform credit checks, and a foreclosure mark is a major red flag, and it will cost you job opportunities. This aspect makes recovery from a foreclosure particularly challenging, since it impacts your ability to make money and improve your financial situation.

Going through a foreclosure could be one of the worst times of your life.

The psychological and emotional strain of undergoing a foreclosure should not be underestimated. Losing your home, your most valuable asset and a place of security for your family, is devastating. The process leads to long-term strain, making it difficult for you to regain stability and rebuild your life. This emotional toll, coupled with the financial impacts, highlights why it's crucial to explore all available options to avoid foreclosure.

You have limited options.

Understanding the full scope of consequences should motivate you to seek alternative solutions like a loan modification or selling your home to an ethical investor through FairOffer. These options will help you skip the foreclosure process and its negative fallout entirely. This solution not only preserves your financial health but also spares you from the considerable stress associated with foreclosure proceedings.

Loan modifications cost thousands of dollars and come with worse terms.

If you find yourself facing foreclosure, one option might be to apply for a loan modification, but this route comes with its own set of challenges and uncertainties. Firstly, you must apply for the modification at least 45 days before the scheduled foreclosure sale of your home, which requires forward thinking and prompt action during a stressful time. There’s no guarantee of approval. While each lender varies, they reject around 40% of these applications. The deck is stacked against you from the get go.

Part of the application process involves writing a hardship letter detailing your financial struggles. This is not only embarrassing but also damaging to your application if not written correctly. Poorly written letters with grammatical errors or overly dramatic content are not taken seriously by any lender. Additionally, the hardship letter could become public information in the event of any legal action associated with the loan. You have to make sure the information is accurate so the bank cannot accuse you of fraud in the future.

Loan modifications often do not come with great terms and can add additional stress.

If you manage to pass the initial hurdles and your application is considered, the demands can be steep. You will need to demonstrate that you have the funds to make the adjusted payments, which might already be a stretch given your financial predicament. Lenders often require a substantial payment upfront towards a principal reduction, usually amounting to thousands of dollars. Even if the modification is approved, it typically extends the term of your loan, meaning you'll end up paying more over a longer period—an option that could strain your finances even further.

The best real estate agent in the world cannot help you with your foreclosure.

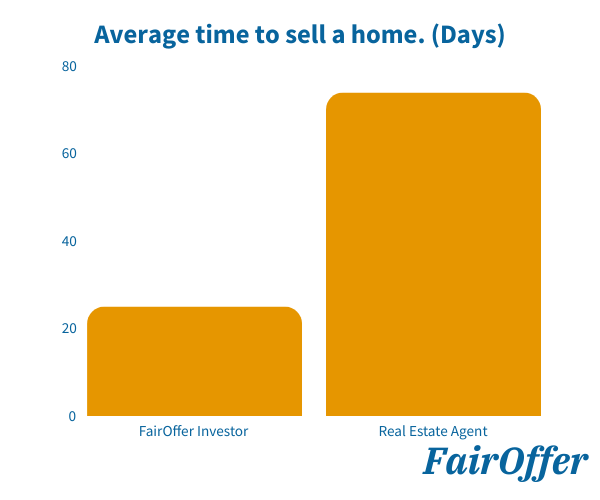

If you decide that you want to try to sell your home, it's important that you understand that even the most talented real estate agents are powerless to help you in the face of a pending foreclosure. The pressing timelines associated with foreclosure proceedings often don't allow enough time to list and market the property properly.

Traditional real estate sales strategies, such as staging open houses or implementing extensive marketing campaigns, become impossible to execute due to these time constraints. The typical duration required to close a sale through conventional real estate channels almost always exceeds the time limits set by foreclosure deadlines. A traditional sale is not option for foreclosure relief.

Even if a real estate agent were successful in quickly finding a potential buyer, there's no guarantee that the buyer would have the necessary funding arranged to close the deal swiftly.

Banks involved in the foreclosure may also complicate matters for the new buyer, causing issues with the title that can derail the sale. Real estate agents lack specific experience in handling properties under the threat of foreclosure. These properties require a different set of strategies and knowledge about navigating legal and financial challenges associated with these situations.

The best thing you can do is sell your house quickly for cash to an investor.

Ignoring a pending foreclosure will not make the problem disappear. Doing nothing in the hope that the situation resolves itself will lead to more severe consequences. A foreclosure will have a devastating impact on your life. Simply put, inaction is not a strategy and will not prevent the foreclosure process.

Dealing with foreclosure through traditional methods are expensive and risky. Loan modifications require substantial up-front fees and they'll give you worse terms. Foreclosure attorneys are expensive and do not guarantee successful outcomes. Real estate agents face insufficient time to effectively market and sell the home before the foreclosure deadline.

The most practical and effective solution is to sell your house to an ethical investor through FairOffer. This approach allows for various flexible options. You could sell and move elsewhere, securing some financial return. You could arrange to stay in your home and buy it back. You could even find a tailored solution that allows you to avoid foreclosure while planning your next steps.

FairOffer ensures that all parties involved — you, the bank, and the investor — benefit from the transaction, aiming for outcomes where everyone’s needs are met and your financial stability is preserved.

Most people who work with FairOffer's investors keep living in their homes.

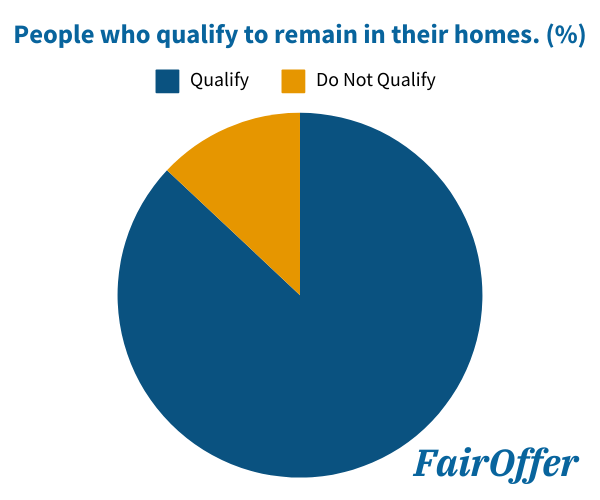

If your house is in foreclosure, staying in your home becomes considerably more difficult. The investors connected by FairOffer may be able to help you remain in your house, depending on the specifics of your unique situation.

You could potentially become a tenant of the investor who buys your home with an option to repurchase it within a timeframe, usually between 1 to 5 years. This approach is faster and better than dealing with a foreclosure because you would lose all the money you put into the home and no longer have a place to live. Banks love this approach as it maintains property continuity and reduces the complications and costs associated with foreclosure.

Since this process is quite detailed, the best way to find out if you make such an arrangement is to see if you qualify. 87% of people who apply qualify and many opt to remain in their homes. There is a good chance that you would, too.

Banks don't want to foreclose on your house.

Understand that banks do not want to throw you out of your home. They want to maintain a positive relationship with you. Foreclosure is the last resort for banks. They are not in the business of real estate investment but rather in the business of leveraging money to make money. They will only proceed with foreclosure if absolutely necessary, preferring to explore all other avenues to resolve the situation. Banks aim for solutions that retain their customer relationships rather than disrupt them.

By working with skilled investors, banks can find more favorable outcomes, and this is where FairOffer plays a vital role. FairOffer connects homeowners with ethical investors who can offer solutions that benefit all parties involved, including the banks. This collaboration leads to the best possible outcomes, preventing foreclosure and maintaining homeownership whenever feasible.

There is hope for people like you who are facing foreclosure.

Let these parting thoughts offer a beacon of hope. While your situation is very serious, there are options available that can provide you with the support you need to navigate through tough times. If you're facing financial challenges with your home, you should make the decision today to get back on the right track. Fill out the contact form right now and see if FairOffer can help you. Many people are surpised with the results.

See if you qualify for foreclosure relief.

A summary of your options:

- You can do nothing and ruin your financial future.

- You can spend thousands of dollars to modify your loan and get worse terms.

- You can sell your house and skip the entire foreclosure process. Fill out this form to see if you qualify.

About FairOffer

FairOffer is a program designed to help homeowners like you prevent foreclosure. We'll connect you with ethical investors who specialize indealing with foreclosure. There is absolutely no cost to work with FairOffer, and you are under no obligation to accept any offers received. In most cases, you can negotiate arrangements with investors that allow you to keep living in your home. See if you qualify to work with a FairOffer investor right now.

Share this article.

If you found this article interesting or useful, please share it. You may help someone else.

Frequently Asked Questions

If I get an offer, am I under any obligation to sell?

Receiving an offer through FairOffer does not place you under any obligation to sell your property. You are free to accept or reject the offer based on your preferences and circumstances. The decision to sell remains completely in your hands until you formally accept an offer.Are there any fees or commissions that I have to pay out of pocket?

With FairOffer, you will not encounter any out-of-pocket fees or commissions when you sell your home. All associated costs are typically handled by the investor, ensuring a smooth transaction without any unexpected financial burdens for you.How does FairOffer screen the investors that it works with?

FairOffer rigorously screens each investor to maintain high standards within our network. This includes thorough evaluations of their past performance and financial capabilities, ensuring they have the necessary funds and integrity to deal fairly with homeowners. Only investors who meet our stringent criteria are approved to make offers.What if my house has structural, title, or financial issues?

FairOffer's investors are prepared to buy houses in "as is" condition, which includes properties with structural or title issues. This means you do not need to invest in costly repairs or solve complex title problems before selling—our investors handle these issues post-purchase.How do the investors determine the price?

Investors working with FairOffer determine the offer price based on a comprehensive analysis of various market factors. This includes the current market conditions, the property’s location, its condition, and comparable sales in the area to ensure a fair and competitive offer.Does FairOffer buy houses?

FairOffer does not directly purchase houses. Instead, we connect homeowners with a network of pre-vetted investors who can make fair, competitive cash offers. Our role is to facilitate a smooth connection between you and potential buyers who are ready to purchase.Does FairOffer list houses on the MLS?

FairOffer is not a real estate agency and does not list houses on the Multiple Listing Service (MLS). Our service is focused on direct connections between homeowners and investors, bypassing traditional listing processes to streamline sales and enhance efficiency.© 2024, FairOffer. All rights reserved.